|

In this number of the green indicator, we will have a closer look on how to introduce new, renewable chemical and energy processes into the marketplace and what underlying factors govern the success of such an introduction. In the introduction of new processes it is of importance to keep track of various trends and changes in the marketplace. One such major paradigm shift is the change in leading chemistry market where it is anticipated that the US will be surpassed by China in chemical market size during 2011.

/ Christian Hulteberg

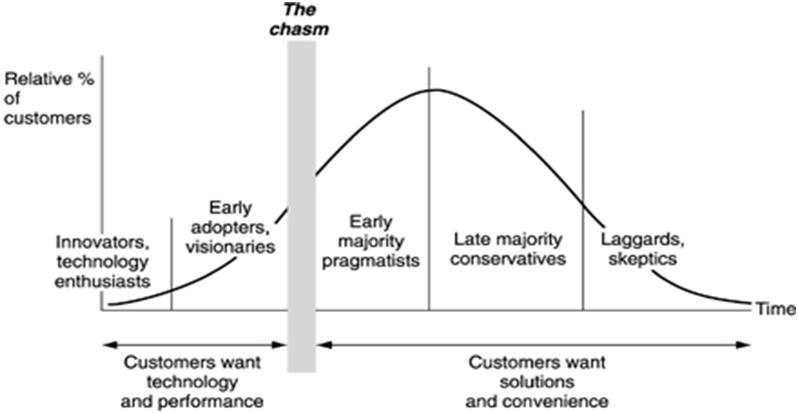

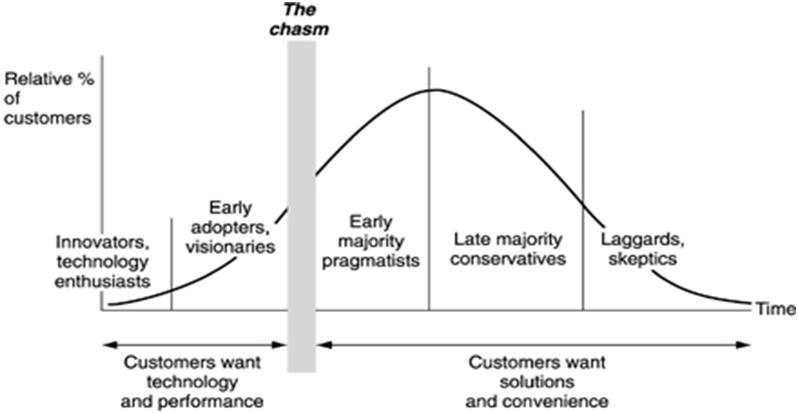

Crossing the renewable chasm

Most people involved in developing and selling new, technology-based products are (or at least should be) aware of the book “Crossing the Chasm” by Geoffrey A. Moore. Focusing on the marketing and selling to mainstream consumers. At first glance, the book appears to be addressing the introduction and sale of IT-related products but when digging deeper it is apparent that it describes the behavior of introducing all kind of new technology. Or as it was wisely put by Jonas Velander: “IT is to technology development and introduction what banana flies are to genetics a fast lifecycle specie where effects become apparent rapidly”.

This means that the same gatekeepers are controlling the development and introduction of renewable fuels and chemicals as is the case in other new technology. There is one difference though: economies of scale. This means that we still need to convince the innovators, visionaries, pragmatists, conservatives and skeptics out there in that order to be able to introduce a new process on the market. The problem is that cost of crossing the chasm in renewable chemicals or energy is usually high; and the reason for that is the cost associated with developing the technology. First of all the technology need to be invented, developed and demonstrated in the laboratory scale which is a low investment compared to the next step, which is a scale-up to either a pilot or commercial-demo scale, requiring an investment several orders of magnitude higher than the initial development cost; and interestingly enough, the chasm is still to be crossed.

After performing a successful pilot demonstration or commercial demo, which of course requires the buy-in of a visionary with the resources to fund the effort, another investment, again order of magnitude larger than the pilot investment is required for constructing the first commercial unit. In this, there will have to be commitment not only from the visionaries but also the pragmatics that are responsible for such things as plant operation and maintenance, as this then becomes a question for the non-technical developing part of the organization. After this, and only after this, the technology can be sold to other pragmatics requiring a fully functional and demonstrated technology.

However, every situation is unique and the capital access in the company may very well play a role in deciding when to bring a partner into the game. The importance of finding a reference case or customer to drag you across the chasm becomes more and more important depending on the capital requirement of the development and scale-up. With this said, it should be stressed that focusing on one target niche is still very important. Few, if any, companies manage to penetrate several markets simultaneously and every target market requires customizing of the product making them non-generic products to the customers.

So the takeaway of all this is to find a partner or capital to help you across the chasm and stay focused until you dominate your target niche before moving into a new one.

|